Not all insurance agents stay in business by ripping you off.

The Basics

Insurance structures monthly payments called premiums to insure your valuables. If you make a claim, your insurer will pay out the loss covered by your premium. You shouldn’t be wrecking your car monthly. Your money is pooled with other policyholders and is used whenever you make a claim. If you make too many claims, your premium increases.

Insurers use your data to determine how risky you are. The higher your risk, the higher your premium.

It’s important to remember how insurance is structured when deciding to add extra coverage. If you’re paying a small amount, you’re probably insuring for a low-likely event for which you could self-insure

What is it?

Insurance isn’t an investment (despite what agents may say); it’s a transfer of financial risk from the purchaser to the seller.

Your insurer absorbs the risk of something bad happening for a predefined amount of payments. If that catastrophe happens, your insurer pays. If it doesn’t, the insurer keeps your cash.

When you take out a policy, you’re not hoping your house is destroyed in 10 years after it’s appreciated to make a few dollars. You’re paying your provider to cover your risk for whatever you’re insuring because you don’t have an extra $200,000 laying around to buy another house.

When to Buy Warranties

Buying insurance and warranties is a business decision. Paying $10 per month to insure a $20 surge protector isn’t financially savvy; business’ prey on consumers who are risk-averse, meaning they are reluctant to take risks.

For example, about half of the amount you pay for extended car warranties go straight to the salesman’s commission. You can often save money by paying out of pocket if any problems happen. Many dealers selling new cars make more on warranties and add-ons than on the actual vehicle.

Consumer reports surveyed 8,000 of their readers and found 65% of them paid more for their extended warranty than they received through the problems it fixed. Don’t get duped by car companies just for peace of mind. Similarly, many extended warranties cost almost a third of the price. Compare the cost to skip the warranty so you can pay for repairs or a new computer.

You must think long-term to win with insurance. When you request higher deductibles— the amount you pay out of pocket when you make a claim— you get lower premiums and can self-insure. So taking a $1,000 deductible, as long as you have money to pay for any accidents, can save you money over the years.

Depending on your finances, you could self-insure anything from $1,000-10,000. You want to insure items that would be hard to replace, such as your life or home.

Know What You Pay For

Insurance packages often come packed with things you don’t need. Go line-by-line to see if you’re paying for rental car insurance when you rarely rent cars.

Many insurance policies rip you off.

- Pet insurance

You should be able to pay your pet’s medical expenses out of pocket. It’s usually better to save up for emergencies rather than pay monthly in case anything happens. - Rental car insurance Many credit cards already cover collision for rental cars, and your regular auto policy covers liability, so skip that extra fee (after checking your credit card terms).

- Life insurance on children The purpose of life insurance is to replace your income if you die. Unless your children are internet prodigies, you can most likely live without their income.

- Policies that pretend to be investments

Life insurance isn’t an investment. Some whole life insurances accumulate cash value, but you’d make more money by keeping money under your mattress, even after depreciation, than after buying whole life policies. Variable whole life policies allow you to place premiums in the stock market, which could raise your premium since less of your money goes to cover the premiums.

5. Travel Insurance

Policies that protect against flight cancellation, delays, or lost luggage are usually a waste. Many credit card companies include cancellation and baggage insurance.

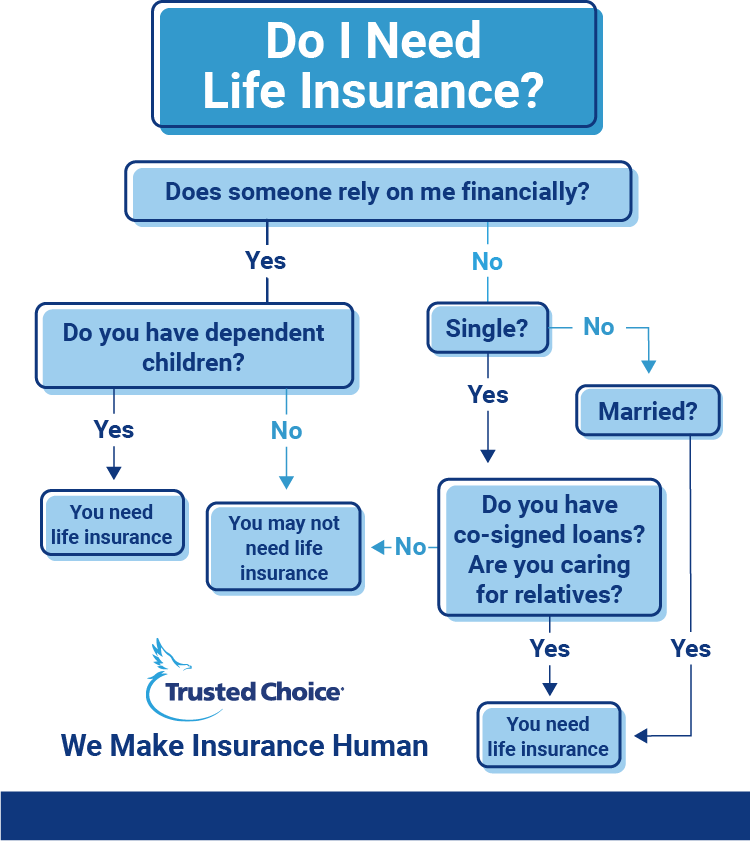

Life insurance can get complicated, but these are the basics. Find an agent who will teach you what you’re buying.