You can’t afford not to invest your money if you want to save it or grow it. If you hide it under your mattress it’ll be eaten by inflation, and if you keep it in saving accounts, the bank will lend it out making seven percent of it, and then give you less than one percent. Check out the long term implications of holding money in the wrong place, courtesy of Andrew Fiebert of Listen Money Matters.

The only reason you shouldn’t invest money is if you have to borrow to do so, or if you plan to use the money within five years. If you’ve racked up credit card debt you should pay that off first to avoid the payday-lender type interest rate. The market has its ups and downs, and you need enough time to ride the waves, but you should make money if you diversify and don’t make irrational choices.

So what is investing? People have a positive time preference, meaning they prefer things now rather than later. So you will pay more to have Amazon ship your Xbox in one day instead of three. Investing is letting other people use your money whom you believe will make more money and then pay you the money plus interest. You can invest in company stock, in real estate, or in startups.

It’s 2019 so you can invest as easily as you can get on Facebook. Acorns, Betterment, and Vanguard are a few taps away before you can choose your investment and even plan for retirement. And the best part of these apps is that they have low fees (.04-.35) so expensive financial planners won’t take large chunks of your money. And why should they? Over 79 percent of human money market managers don’t beat the market average, so I stick with robo-advisors. Wealthfront, one of the heavyweight robo-advisors, will even manage your first $5,000 free if you sign up using this link.

Once you sign up you’ll be asked a few questions to target your goals. Then it’ll gather a portfolio according to your age, risk preference, and income. If you’re younger than 40 I would suggest weighing heavy in stocks compared to bonds (80/20) because although stocks are riskier, they earn more money. Just don’t sell the first time they dip; you only get hurt on a rollercoaster if you jump off.

One of the features is that you can link multiple accounts, credit cards, loans, or retirement accounts to automatically determine your net worth (assets – liabilities). So you can view your whole financial health— for better or worse— and set goals for the future.

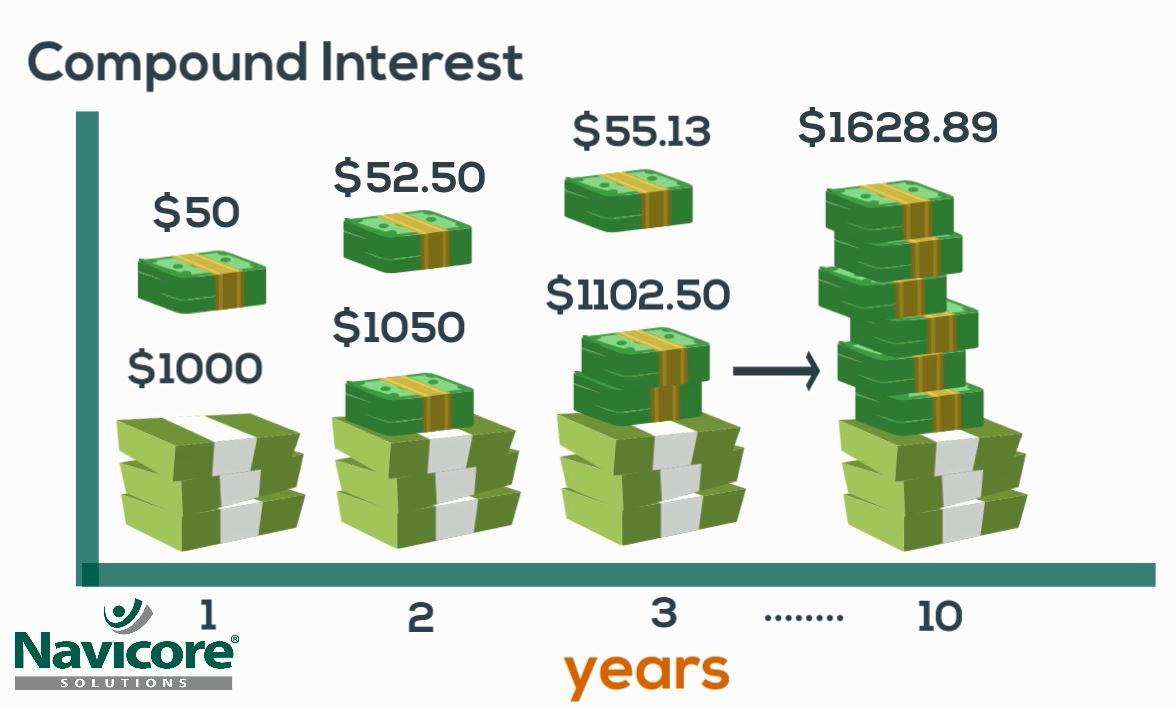

So how much should you invest? A seven percent average yearly gain will double your investment money within 10 years. Think about that next time you impulse buy another lamp at Target.

The best time to start investing was when you were 18, but the second best time is right now. No matter how small the amount of money, start an account that will make you rich instead of your bank.