A new report from the Government Accountability Office found that almost half of older Americans approaching retirement have nothing saved in a 401(k) or individual account.

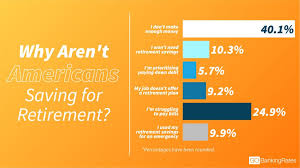

This poor planning could stem from several sources. National saving increased directly after the 2008 crash because many discovered how critical having an emergency fund is, but as the memory faded, so did savings. Boomers may have financed their children’s college, or may still be paying for their living expenses.

Of those 55 and older, 48 percent had nothing saved for retirement, better than the 52 percent in 2013 who had nothing saved.

These numbers should serve as a rude awakening to millennials who very well could foot the bill for their parents.

A few plans could start to solve this problem. As Richard Thaler mentioned in “Nudge,” employers could automatically opt-in employees to 401(k) plans. Many employees forget to opt-in, or get so lost in the paperwork and options that they push off the task to do “next month.” Simplifying paperwork and options would vault the amount of Americans enrolled in tax-deferred retirement plans. Every person should enroll in a 401(k) plan if they have an employee match; it’s literally free money.

But just starting a retirement plan doesn’t mean it’ll be there when that person retires. Many people use their 401(k) as a savings account, so your mindset is still key to financial stability in retirement.

- Technology and virtual reality could bridge the gap of the immediate payoff of investing. When we invest, we delay pleasure for the future. As a 23-year-old, it’s hard for me to imagine myself at 50; I have no idea how my life will look. But if I wore VR glasses to see myself at that age, I would significantly increase my saving levels. Thankfully, the money I should have by then from investments I’ve made now drive me to save. But for parents and older people, you have to find your “why.” It may be that you want to pay for your child’s college or to change the financial history of your family. You need a reason to delay buying brand new cars or eating out so much that you decimate your retirement.

- Simplify investing; the concepts and methods

While I was growing up, investing seemed like a rich person thing. I thought I would need a broker to whom I would pay a ton of money. I believe this mindset is one reason why so many Americans have dismal saving. But the game has changed; roboadvisors such as Wealthfront and Betterment have made investing as easy as downloading an app, and along with Vanguard, high fees are history. All three have plenty of options with less than a .5 percent fee. You have no reason to avoid investing.

Good news to those older Americans with no saving: it’s never been easier to make money. Get a side hustle, sell things on Amazon, or drive for Uber. While retirement may sound glamorous (yawn), studies show that people who retire die much earlier than those who continue working. So start an encore career in which you make great money. If you need ideas, look at the list on Listenmoneymatters.com, jump on google or ask your grandson. It’s never too late to start saving, and with many people working into their 70s, you’re not alone. Just think: if you’re 55, you could grow your money for 20 more years. If you invest 10,000 into Vanguard index funds, you could earn 50,000 after ten years. So what are you waiting for? Get up and grind.